Working women power increased spending on clothing

Over the last 30 years, there has been an increasing number of women worldwide participating in the workforce. Women’saverage disposable incomes are rising and the gender gap is closing, albeit at different rates in different parts of the world.

As more women work, there has been an increasing demand for women’s business wear. There is a significant and growingpopulation of affluent women in the 35+ age category, as well.

With their rising incomes, women are enjoying greater spending power and they now have the ability to decide (or co-decide)how resources will be distributed within the family. This rising purchasing power and greater decision-making authority hasmade women, especially those in employment and aged 24-54, a large and powerful segment of the consumer market.

Outlook

Globally, the rise in the number of working women is expected to continue, particularly as better childcare facilities and homesupport systems become more available. It’s also anticipated that women will marry later in their lives and will start theirfamilies later than their parents did.

The consumer segment of older, affluent women will only gain strength in the future.

Higher levels of education for women will likely translate into higher salaries, which will increase their purchasing power evenmore. The traditional guilt that many women carried when spending on themselves is also expected to decline, leading togreater spending on women’s products.

Impact

The growth in disposable income as a result of more women in the workforce has already had a positive impact on allsubsectors of the women’s clothing market. Sales of women’s outerwear are expected to be strong over the forecast period.Manufacturers and retailers are expected to focus their efforts on meeting the needs of women aged 35+, who have largedisposable incomes but are increasingly unhappy with the fashions available to them. This segment of the population isattractive to clothing manufacturers and retailers because they do not have qualms about spending money on clothing and donot always opt for the least expensive items. These women also criticise designers and retailers for focusing too much on theyouth market, and they are clamoring for fashionable clothing that is built to fit more mature bodies.

The increasing demand for office wear, not only suits but also more “dressy” items such as shirts, jackets and dresses, will bea primary driver of growth in the women’s clothing sector in the future.

More money in the hands of women consumers is also good news for the children’s wear market, as older mothers look to buymore and better quality clothes for their children of all ages.

Buying Power:

Catalyst.com:

- Education is a factor in income and spending – higher degrees lead to highermedian salaries as well as increased expenditures.College graduates’ average annual expenditures in 2006 were$63,864.

- Married couple families in which the husband and wife work had far highermedian incomes ($81,891)

Overall, online retail spending from August through October grew just 4% versus year ago, with spending declining by 3% among households making less than $50K/year.

· Households with income between $50K and $100K showed marginally positive spending growth (1%).

· Households making at least $100K increased their spending at a healthy rate of 14%.

AGE: 30-44 is looking good!

30-44:have the highest % of middle incme(our target market).

http://pewsocialtrends.org/pubs/706/middle-class-poll

http://www.marketresearch.com/product/display.asp?productid=1164895&xs=r&SID=76729790-428310118-487961560&curr=USD&kw=&view=toc:

Women aged 45+ continue to increase in number, but the 25-34s represent the biggest change in the next five years .

Generation Y did not cut back spending even in Economy downturn: http://www.marketingvox.com/black-friday-vs-cyber-monday-shopping-differs-by-generation-042189/

THE INTERNET LIFE: IT'S ONLY JUST BEGUN

Byline: Dick Silverman

NEW YORK -- The Internet era has just begun. For the last two years, Internet activity has soared, but there's still a long way to go. By 2010, virtually all U.S. households will be hooked up to the Internet via computers, TV, telephones and other devices, according to research from PricewaterhouseCoopers.

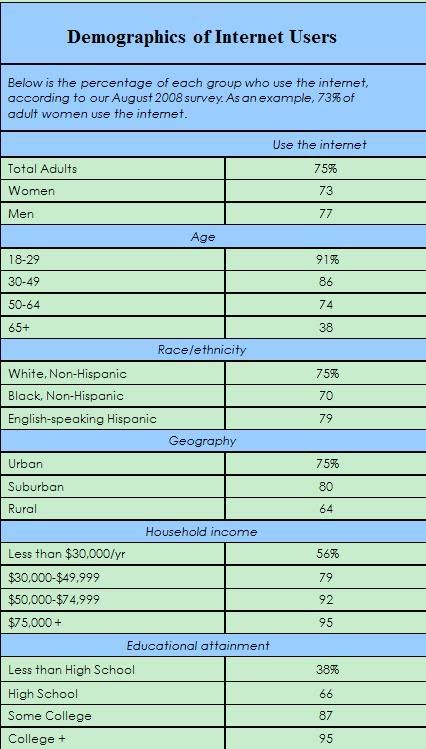

Forrester Research is estimating that the number of households with Internet access will keep climbing during the next 10 years. And as Web sites and Internet technology evolve, online shopping will become a common activity, the PricewaterhouseCoopers report predicted. "Consumers will expect retailers to be available online, as well as on land," the consulting firm advised. "Retailers will be required to shoulder the financial burden of making sure that consumers can access them through a variety of selling platforms." Consumers will routinely use the Internet for more than just shopping. They'll use it to research products they might buy, obtain information from experts and to communicate with family and friends. The Internet is expected to become particularly popular with young people. When asked in a study by Yankelovich Monitor if computer technology will allow them to gain more control over their lives, 61 percent of Generation X'ers said yes, compared with 57 percent of baby boomers and 37 percent of older consumers. According to PricewaterhouseCoopers' research, 48 percent use it for shopping. As a result of the steadily growing Internet use, PricewaterhouseCoopers anticipates consumers will become more savvy shoppers, which means they will shop a wider selection of retail venues -- and become less loyal to specific stores. But the study warned that the technology's mass acceptance is hindered by economic obstacles. While 60 percent of households with incomes over $75,000 have Internet access, only 19 percent of households with incomes of $25,000 and $35,000 use the Internet. While consumers at an economic disadvantage may want to improve their prospects, they will have limited exposure to the new technology, the firm noted.

From wwd.com

Population projection:

from U.S census.

Our target market will grow big!

Demography:

Winners include seniors (ages 65 and older), blacks, native-born Hispanics and married adults. The income status of all of these groups improved from 1970 to 2006. Losers include young adults (ages 18 to 29), the never-married, foreign-born Hispanics and people with a high school diploma or less. All of these groups have seen their relative income positions decline.

from:http://www.pewinternet.org/reports.asp

U.S census data.

Summary:

It's very resonable to select our target market (30s' educated working women with >50K income per year)

No comments:

Post a Comment